EVERYWOMAN CUSTOMER

GROWTH PROGRAMME

Build and scale your female customer base

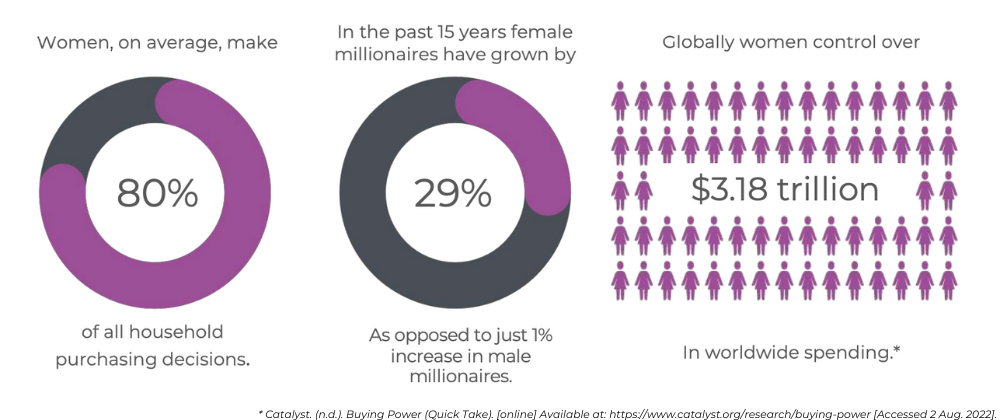

WOMEN ARE AMASSING WEALTH…

It would stand to reason that any organisation would want to leverage this growth in wealth by building and scaling their female customer pipeline. However, with research proving that women behave in business differently and purchase differently, how can you make sure that your front-line sales, marketing and comms teams harness this knowledge for the commercial benefit of your business?

everywoman Customer Growth Programme objectives

Since 2012, everywoman has been delivering it’s impactful Customer Accelerator Programme, with clients including NatWest Bank (read the case study) and ATB Financial. Designed to enable customer facing teams to understand and connect with your female customer base in a way that ensures your business can thrive. Creating loyal brand ambassadors, (women are 7 times more likely to recommend a great purchasing experience) and increasing your market share and sales. All companies can benefit by making their purchasing experience more female friendly, however, those organisations in financial services, technology, electronics and automotive can especially benefit as these sectors are cited frequently for delivering a particularly bad purchasing experience for women.

FEATURE ARTICLE

Unlock three secrets to growing your female customer base

Want more women customers?

Read this free to access article to unlock the latest thinking that can transform your organisation into one that’s attractive to the world’s most influential customers – women.

BENEFITS TO YOUR BUSINESS

Apart from the obvious commercial benefits of engaging with this growing lucrative market, the everywoman Customer Growth Programme imparts a more nuanced understanding of customer needs. The program will:

- Motivate, inspire and give confidence to your customer facing, marketing and comms teams in their dealings with existing and potential female customers

- Minimise the frustration borne out of the disconnect that sales and relationship managers have when faced with the different behaviours of female purchasers

- Finesse your sales processes to align with the way women want their purchasing experience to be

Officially Accredited Programme

The everywoman Customer Growth Program is accredited by the Chartered Banker Institute. Every participant that passes the Accreditation will receive a certificate from the Chartered Banker Institute and everywoman Ltd. We can work with other governing and accredited bodies relevant to each sector.

The everywoman Customer Growth Programme has been developed by everywoman Ltd. All intellectual property rights belong to everywoman Ltd and the 3rd party associate trainer contracted for the programme. Recordings of the sessions are not permitted. Delivery of the programme by trainers not contracted by everywoman Ltd is not permitted. For further details, please email [email protected]

Contact us to find out more

To enquire about what The everywoman Customer Growth Programme can do for your business, market share and customer-facing teams, email us on [email protected] or complete your details and one of the team will be in touch.