Mastercard launched the Strive UK programme in September 2021, with the aim of providing the nation’s micro and small businesses with access to the tools and knowledge that will allow them to thrive in the digital economy. Kelly Devine, Divisional President UK & Ireland, talks about embracing the power of end-to-end thinking in the digital age for small businesses — and why financial inclusion and digital inclusion go hand in hand.

If recent times have highlighted anything, it’s that all businesses are now digital businesses, whatever their size. Covid-19 lockdowns and the closure of physical retail spaces have exacerbated the demand for small business owners to embrace technology — 41% report that their company would not have survived the pandemic’s challenges without digital tools. And the story is not just about resilience, but growth too, with 47% of small business owners believing technology will become more important to their company’s success over the next five years, and 45% noting that tech has already helped them expand their customer base and increase turnover and profit.

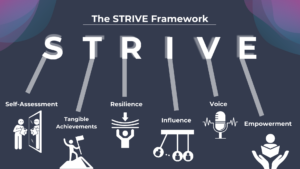

But not all owners have the know-how or support to ‘tech-up’ their businesses. Mastercard is helping to bridge this digital divide with the recent launch of its Strive UK programme, which aims to empower micro and small businesses (particularly those with fewer than ten employees) to thrive in the digital economy by offering free guidance, tools and mentoring.

This will allow small business owners to identify and adopt the right digital tools and technologies for their business. For Kelly Devine the programme is an exciting and timely one. ‘We’re constantly talking about the productivity gap in the UK, but the question is, how can we help those businesses to be more productive? Because we’re Mastercard, when we say ‘digital’ people think we mean payments — taking a card instead of cash, for example. But we might also mean, how do you market your business digitally or manage inventory? Or, how do you manage your accounting and invoicing so that you can get paid on time and can optimise your cash flow for your business?

‘It is end-to-end thinking about all the different elements of being more digital, and how choosing the right digital tools and getting value out of them might help businesses grow or just be more productive and efficient.’

Small businesses are mission critical to the UK economy. They employ almost half of the UK workforce and generate one third of private sector turnover. Mastercard’s Strive UK programme looks to tap into a £827 billion growth opportunity for UK’s small businesses and empower 650,000 micro and small enterprises to thrive in the digital economy over the next three years and beyond.

The pandemic has laid bare the urgency to level up digital transformation generally, but importantly, it has also highlighted the barriers and challenges that women and minority-owned businesses in particular face around accessing funding and tech knowledge. Financial inclusion is digital inclusion in today’s world — and digital inclusion requires social inclusion. Data shows that 39% of small business owners feel overwhelmed by the amount of choice when it comes to technology, and 32% want to use more digital tools but are unsure which ones would be best for their business. This uncertainty rises to 49% in the case of businesses that are owned or run by those from ethnic minority backgrounds, highlighting a need for highly-tailored, focused support.

Says Devine: ‘We spent a lot of time listening and talking to people who were in these businesses and in trade bodies so that we understood the issues and challenges they faced. What we found was that typically the businesses that were more adversely impacted were those led by people who are underrepresented. Black and Asian business owners were more likely to have to close their business and women-led businesses were more likely to see an impact in turnover than male-owned businesses.’ Indeed, research shows that 72% of female firms have reported lower volumes and lower revenue relative to 52% of white, male-led businesses as a result of lack of digitisation.

‘We know that because of the way in which support has historically been constructed and served up, it has often been less accessible for some of these groups. What we wanted to do with Strive was to design something that met the needs of a representative group of business owners, recognising the dynamics in that marketplace.’

The accelerated change of the digital age and the demands and challenges it presents are something that Devine knows well. ‘I spent ten years of my life in commercial payments for businesses, so thinking about how businesses manage their payments and their cash flow, how they invoice and how they get paid is something I’ve spent a lot of my career doing. And the change I’ve seen from when I started in how long it takes businesses to get paid, for example, is immense. It’s such an important conversation now.’

Even so, for her, the most striking findings of Mastercard’s research were the primacy that small businesses put on digital — even citing it alongside funding on their list of top three things they needed. What also struck her was just how lost many people feel on that journey.

‘Many businesses don’t know which area to focus on when it comes to going digital. Do you focus on cash flow? On marketing? Where do you start? There are so many different tools out there and the question they have is what’s right for me and then how do I get value from it?’’

To help support small business owners through this transition, mentoring is a crucial piece of the Strive UK solution. ‘What mentoring can do is instil confidence — someone who actually sits down and who can say, “This is what worked for me and my business, and this is what I think will work for you and yours.’’’

Ultimately, the stakes are as high as the potential pay-off for greater inclusion. ‘We can always talk about the importance of equality of opportunity. But you also can’t manifest that £827 billion potential growth if you’re only tapping into 40% of the population. We must ensure that small business owners from all backgrounds have an opportunity to thrive. The cost of not doing so is just too big.’

For Devine, one of the most inspiring parts of the Strive UK programme is meeting the business owners themselves. ‘I’ve been talking to some of the different businesses who are starting to interact with the programme and these people are awe-inspiring. For example, they might be someone who has a day job, but saw some amazing jewellery in Turkey and now they’re importing it and they’ve built a business in their spare time. And they’re now thinking about how to take their business further, with all the get up and go and the leap of faith that that requires,’ says Devine.

‘The chance to see that replicated is huge. If we can be successful with any meaningful percentage of that population that we engage with, then we can have an extraordinary impact on people’s lives. Of course, that will play through to the economy and that will be great for the resilience and economic health of the nation. But when it gets exciting is when you talk to actual people — that’s the really inspiring bit.’

To find out more about how Strive UK can support your business to thrive visit mastercard.co.uk/strive

All data referenced in this article is taken from a report commissioned by Mastercard, ‘Striving to Thrive: The state of play for UK micro and small businesses’ from the Centre for Economics and Business Research (Cebr).[RM3] Published September 2021.

Sign up to ensure you receive the latest thought leadership and gender diversity news from everywomanReview straight to your inbox.